[Editor’s Note: Origin is making it easier for you to save on taxes and generate income, especially if you’re looking to move from active management in real estate to a more passive investment. With the Origin Exchange Program, you can go through the Origin platform to complete a 1031 exchange, which allows you to defer your taxes (perhaps indefinitely), generate passive income, and simplify your estate planning. Need more information? Watch WCI Founder Dr. Jim Dahle and Origin’s Michael O’Shea talk about it in a recent webinar. If you’re looking to build wealth with a company that has four decades of experience, check out the Origin Exchange Program today!]

By Dr. Margaret Curtis, WCI Columnist

By Dr. Margaret Curtis, WCI Columnist

In February, I have to go to the third white coat investor conference. It’s a great conference and I don’t like conferences in general. I met a lot of cool people that I’m still in touch with, caught up with some friends from years past, ate good food and got a good range. I also got to sit on the “columnist panel” and answer questions from the audience. The only downside to the panel was that they didn’t have enough time to answer everything and you had to listen to Dr. Jim Dahle and Josh Katzowitz argue about Teslas like an old married couple. Some of the things I wish I could say: 1) Tyler Scott’s “rich life” is the journey, but mine works less well; 2) No, divorce is not the end of your happiness or your path to financial freedom; and 3) Want to know how we all organize our finances? I am happy to share.

You might think that someone who has been to three WCICONs (with another coming up in February 2025) would have their finances running like a well-oiled machine. You would be wrong. In my house, we follow the 80/20 rule which says: spend 20% of your energy doing 80% of any project, and then the last 80% of your energy goes into the last 20% making you better. Most of the time it’s better to just do the first 80% of the project and then call it good. This rule applies very well to a lot of activities in everyday life: washing clothes and cleaning the garage, for example (80% wash clothes don’t match socks).

It also applies to keeping track of our money. If you accept “good enough” as the standard most of the time, you free up a lot of time and energy for activities that require your undivided attention (like surgery) or are more fun (like skiing). So ditch the perfectionism and read about how we keep our finances organized:

Financial calendar

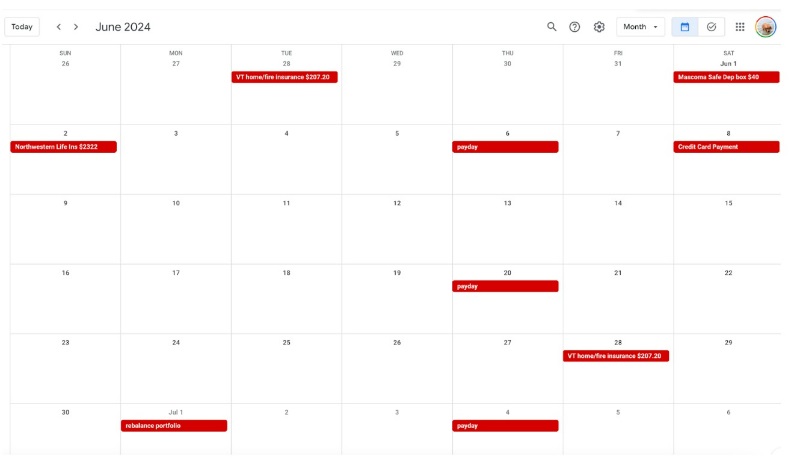

All of our recurring bills are on autopay, but I still like to know when they’re due. Plus, there are the bills that can’t be placed on auto pay (property taxes), the routine stuff (rebalancing), and the question of whether we’ll get paid this week or next? So our finances have their own Google calendar (click to enlarge).

Online aggregator

I have used Personal Capital, now called Empower, for a long time. Several banks and insurance companies offer similar programs. You connect your accounts to the platform and then you can see your overall holdings, performance, etc. It also provides financial planning that I have never done before.

I use it for the asset allocation feature: it shows a breakdown into cash/stocks/bonds/alternatives, which you can then further break down by large-cap, small-cap, etc. This is a nice feature and saves you from having to go through our different accounts to gather all the different holdings. I consider it a blunt instrument because it has several shortcomings:

- Sometimes the platform has trouble connecting to one or more accounts, so if you really want to see the updated totals, you need to go and fix the link. I only do this if a major account is involved. If it’s just our checking account, I don’t care because I check it manually (and don’t count it as part of our investments anyway).

- Asset allocations are not always accurate. Most of our small cap stocks (FSSNX, Fidelity Small Cap Index Fund) are listed in our stocks, but some are listed under “Real Estate” and “Cash”. I don’t know how to fix this, so if it’s a significant amount (like tens of thousands of dollars), I manually add it to the spreadsheet. I once tried to create a really clever Excel formula that would correctly capture each exploit, but I ended up getting really annoyed. Now I consider those smaller amounts to be the last 20% of accounting that would cost me 80% of my effort – in other words, not worth my energy.

Empower also sends me emails that say things like “You spent $86,746 less this month than last!” They do not inspire confidence in me.

Because of these shortcomings, and because the online platform won’t let me move the categories, I also use good old-fashioned Excel spreadsheets.

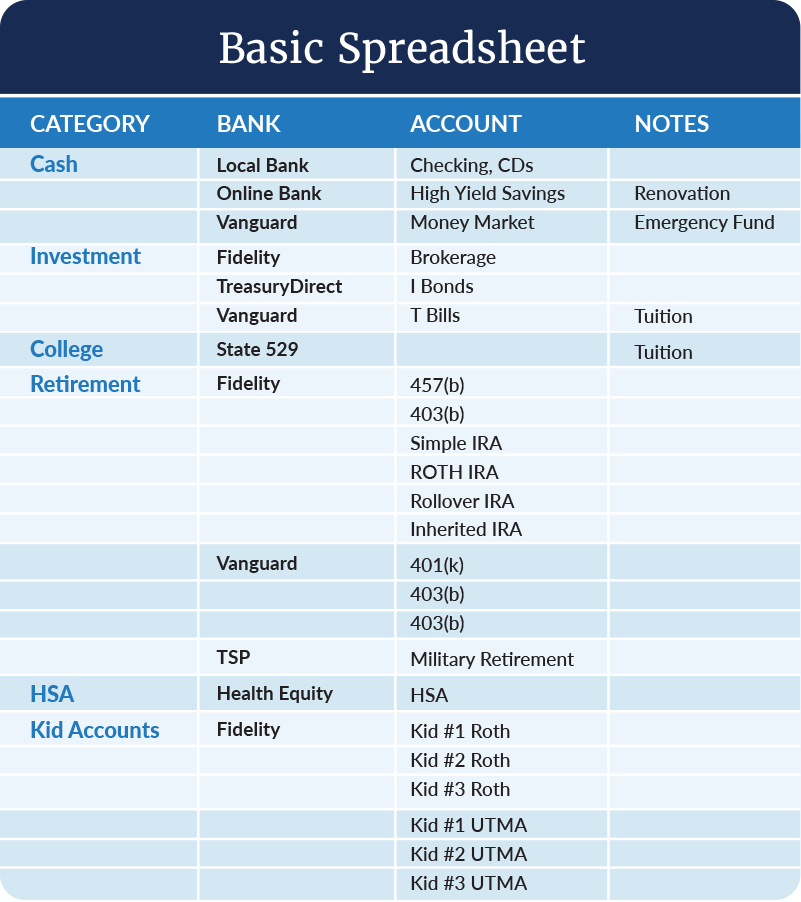

The basic spreadsheet looks like this:

No one tells my kids that I ranked them in numerical order.

I can rearrange the columns to list them by bank, purpose, or whatever else I want. This makes it easy to track where your money is and where it’s going.

In an ideal world, we would have all our accounts at a local bank (for checking) and an investment bank (for everything else). Instead, we have what you see here: a mix. We have retirement accounts from several different employers. We’ve gone over and combined the ones we can, but for some we’re not allowed (non-government 457) or haven’t gotten there yet (TSP).

The logical move would be to transfer all of our accounts to Fidelity, but my husband and I both work for an employer that uses Vanguard, so we’re keeping them for now. We use an online bank for a high yield savings account. The money will be used in the next six months, more or less, so I’m willing to go through the trouble of another account. When we withdraw the money, we will close the account. Some people are willing to have multiple accounts at different banks to get the highest possible rates, but that, for me, is also in the last 20% that would consume 80% of my effort.

Off topic, but I love our local bank. There is a branch in the general store about a mile from our house. I can do my banking, send a package, and buy bulk cheddar cheese all in the same trip. Beat that, Bank of America.

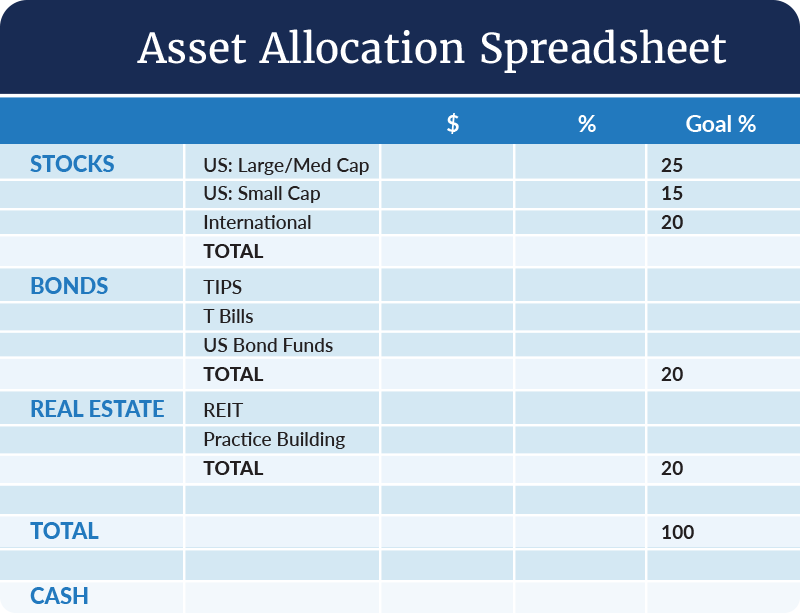

I have another spreadsheet that tracks the actual asset allocation and it looks like this:

You’ll notice a few things about it:

- Our asset allocation is 60% stocks/20% bonds/20% real estate. Stocks are further divided into large/mid cap (25%), small cap (15%) and international (20%). This is a very boring standard portfolio.

- We split bonds into funds bought through our accounts at Fidelity, TIPS bought through TreasuryDirect, and T Bills through Vanguard. I did this to remember to get the totals from each of those accounts, but for asset allocation, all I need is the total from all the bonds. There are people who have a very careful portfolio of different bonds. I am not one of them.

- “Practice building” in the real estate category refers to the building I bought for my husband’s practice. I listed the down payment because I just bought it. In the future, if I were to try to calculate our net worth, I would put down what I think could sell minus what we owe. I’m not including the value of our house, because we don’t plan to sell it.

- Cash is a separate category, apart from the total investment. Some portfolio models use a percentage allocation of cash, usually something small like 5%. As your portfolio gets bigger, the percentage in cash should be lower because you want most of your money to be invested and working for you. I find it easier to just keep about three months worth of expenses in cash rather than a percentage. I include short-term CDs in the “cash” category, but if you’re doing long-term or a ladder of CDs, you can include them in your overall asset allocation.

Setting up this spreadsheet is very easy. Total stock = (large/mid cap + small cap + international). Total portfolio = (Total stocks + Total bonds + Total RE). % stock = (Total stock/Total portfolio).

We don’t use a budget app, although we have used Mint in the past. I’ve heard good things about You Need a Budget. Right now, our downsides are pretty stable. We only have one credit card, so if I need to look at our expenses, I pull out the card statements. If we were trying to change our spending patterns, I would definitely use an app, although it does require some diligence in entering transactions as they happen.

More information here:

What to do with a $900,000 lump sum

How we live our saved lives

Password manager

We just started using it because we got tired of trying to keep all the passwords right for that many accounts. Then, just when we thought we had them right, we’d have to reset one, and that would totally upset the apple cart. We use 1Password because it has been highly rated by several online reviews, but there are others. We did the two-week free trial and then signed up for a one-year plan.

All password managers promise top security. I think they’re more secure than most banks (plus, everyone knows the Deep State already has all our secrets, and the only thing they’re not tracking right now is my cheddar consumption). If anything, our digital lives are safer now because we use the password generator to create real, secure passwords instead of relying on the same five or six over and over again.

File Cabinet

We have one more. We keep hard copies of vehicle titles, birth certificates and property tax bills. We keep a “fees” folder for each year and put receipts and stuff in there throughout the year. We need to shrink the files, but we haven’t gotten around to it. I’m sure there are people who immediately download every form and receipt. One of them should write a column.

More information here:

You should invest like a 50-year-old woman

Living our lives in a dual income physician household

Areas for improvement

In addition to consolidating the bank accounts and getting rid of the file, my husband and I need to start having regular meetings to review the numbers. Our problem is not that we don’t talk about money enough, but that we talk about it too much, in passing, when the need arises or when the mood strikes. We’d do better to take Sarah Catherine Gutierrez’s advice from the conference: Schedule financial meetings with your partner and then stop talking about money the rest of the time. This is good relationship advice, right up there with “don’t ask questions you don’t want to hear the answer to.”

There it is: our good-enough-for-us organization system. I hope it helps. I hope the 80/20 rule works as well for you as it did for us. Tell us about your system in the comments, or come to next year’s conference and tell us in person. Then we can all go do something more fun.

How is your organizational system? Do you feel the need to modify it or is it working well for you? Do you also have a general store where you can send a package and eat some cheese? Comment below!

#Financial #organization #system #good #White #coat #investor