Wednesday, August 28, 2024, 6:00 a.m

| Updated:

Tuesday, August 27, 2024, 6:59 p.m

Investors who want to know how a St James’s Place fund compares to every other vehicle on the market have a problem: they just can’t do it.

Traditionally, funds can be compared by looking at the performance of their assets, minus the fund’s fees, and comparing them to other funds in their sector.

However, St James’s Place fees are expressed as an all-inclusive fee combining the advice, product or platform and the fund fee.

Conformable AM city Analysis, funds from the UK’s biggest wealth manager have on average underperformed their peer group by 6.3% over the past five years, rising to 6.9% when looking at just the group’s shares and products multi-asset.

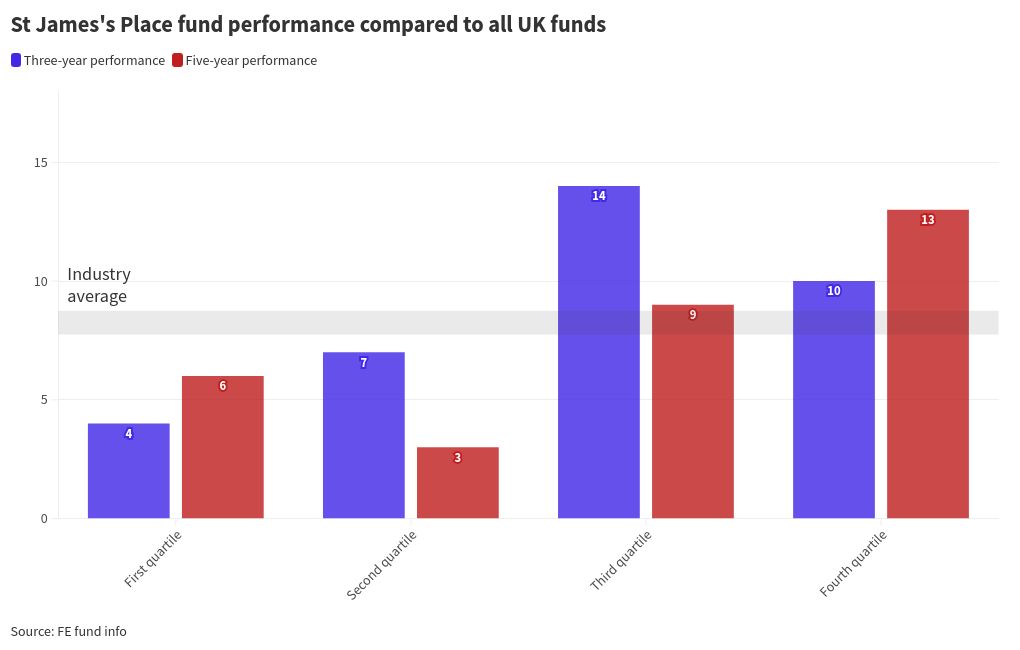

That left just six of the wealth manager’s 31 funds in the top quartile over the past five years, meaning they performed in the top 25% of their peer group.

Conversely, 13 were in the bottom quartile, with a further nine in the third quartile.

Earlier this month, St James’s Place faced negative headlines for running the UK’s biggest “dog fund”, a label for underperforming funds.

The group has three of its funds in the doghouse, the largest being the £10.7bn St James’s Place Global Quality Fund, which has outperformed its benchmark by 27% over the past three years, according to Bestinvest data.

However, these comparisons just don’t work. Despite not posting stellar performances, an accurate assessment of St James’s Place against its rivals is not possible due to the wealth manager’s unusual fee structure.

St James’s Place fare structure

This complex fee structure has been a big part of why the company has been plagued by such poor media coverage over the past year and criticized as “opaque and complex” by analysts.

“The operational and cultural DNA of St James’ Place dates back to the 1980s,” explained Andy Agathangelou, founder of the campaign group Transparency Task Force.

“Of course, the market has continued since those days; The market is no longer willing to tolerate high, opaque fees and mediocre investment performance, and there is no doubt about it – high fees eat away at profit performance.”

Meanwhile, almost every other fund on the market will simply list its management fee and can be bought by investors on a platform, which will then charge an additional ‘platform fee’. Alternatively, they can be bought through an adviser with an adviser fee on top.

This allows you to track the performance of the fund and compare it to others without having to try to find out the platform’s tips or fees.

This criticism came to a head last October when the Financial Conduct Authority’s new rules on consumer charges and customer complaints reached the point where St James’s Place was forced to announce it would scrap its controversial exit charges and will separate the other charges for the first time. .

“The fact that you can’t split the charges into strikes is at the heart of why they’ve announced they’re going to make fee changes,” one analyst said. AM city

With the changes expected to be implemented by the middle of next year, analysts said AM city that clients will finally be able to tell if their investments are performing well.

However, while taxes are split, they won’t necessarily go down.

How expensive is St James’s Place?

Ben Yearsley, director of Fairview Investing, said the “big issue” for the wealth manager was still fees, not necessarily performance. Like growth compounds, taxes do the same.

Yearsley pointed to the bundled fees for a fund such as St James’s Place Emerging Market Equity, which charges 1.84%.

“That’s about 0.75% or more than most peers in that sector – over five years that works out to about 4% underperformance,” Yearsley said. “Surely a simple way for them to improve performance is to charge what the rest of the industry is charging!”

The average fee for a St James’s Place fund is 1.59 per cent, 0.5 per cent of which is the ongoing advice fee, which pays for financial advice provided by an SJP partner.

Even when this is discounted and the cost of the average platform charge is taken into account, St James’s Place charges are still clearly expensive.

Earlier this month, AM city revealed that the UK’s biggest multi-asset range, St James’s Place’s Polaris funds, charged significantly more than their next best competitor, the Vanguard Lifestrategy range.

“What some would consider its many virtues and service-centric brand values have so far enabled the wealth manager to ‘defy the laws of gravity’ in a manner quite similar to the myth of the bumblebee; in theory unable to fly, but in fact it does, with aplomb,” Agathangelou added.

“But there is no certainty that this state of affairs will last forever – true IFAs are getting better and better at inundating their clientele with over-the-top service offerings – so all else being equal, why would a well-informed customer pay more than necessary for what is necessary to obtain?”

A spokesman for St. James’s Place said they “do not recognize the performance figure quoted” but that the fare structure was being simplified.

“When considering performance, it’s important to consider all the fees someone will pay to make a like-for-like comparison,” the spokesman added. “Under our current fee structure, the performance of SJP funds includes a single ongoing fee, which covers external fund manager, administration and advisory costs.”

The “unbundling” of fees in 2025 “will have the effect of simplifying comparisons with our peers”, they said.

“Most of our clients have their capital allocated in diversified portfolios of investment strategies,” they added. “In our view, this is the best way to achieve client outcomes and deliver risk-adjusted returns over the medium to long term.”

#Jamess #Place #high #fees #hide #real #wealth #manager #performance