The number of jobs taken in New Zealand fell for the fourth consecutive month in July, according to data from Statistics NZ.

The figures point strongly to further increases in the unemployment rate.

The release of Stats NZ’s Monthly Employment Indicators (MEIs) showed that on a seasonally adjusted basis there was a fall of 2,975 (0.1%) in the total number of jobs in the country to 2.37 millions.

ASB senior economist Mark Smith noted that employment was 0.5% lower than this time last year, “the weakest since the GFC [Global Financial Crisis]with the July level 1.1% below the March 2024 peaks”.

It is the first time since the GFC that this data series has recorded four consecutive months of declines on a seasonally adjusted basis.

The MEI figures are not directly comparable to the unemployment figures that come from Stats NZ’s Household Labor Force Survey (HLFS) – but they tend to be a good forward indicator.

Unemployment in the June quarter was 4.6%, rising steadily from its cyclical low of 3.2%. The Reserve Bank forecasts that this current quarter unemployment will rise to 5.0% and is expected to reach 5.5% next year.

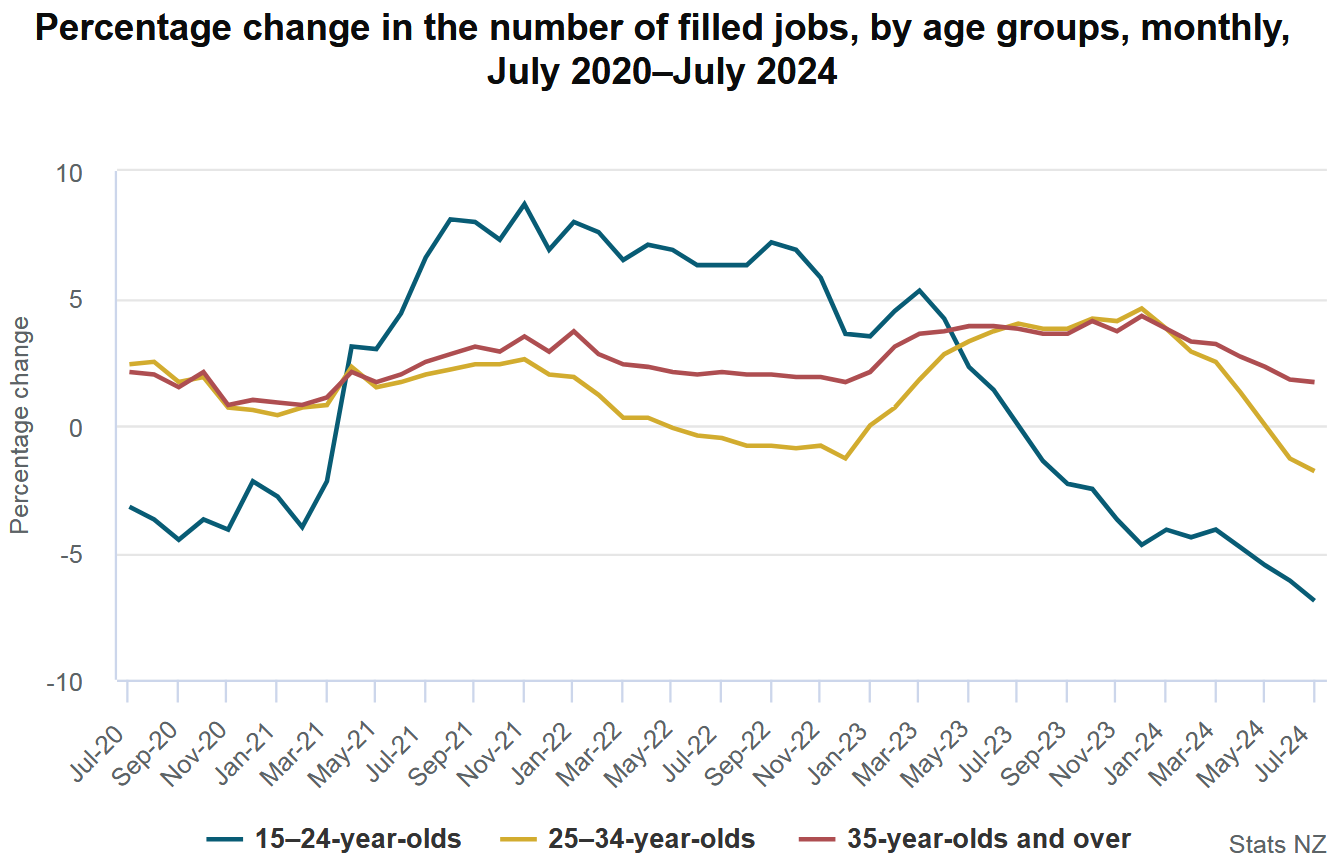

In its MEI release for July Stats NZ noted that the decline in employment occurred across all age groups, but referred to the degree to which youth employment had graded and said that in the three months to July 2024, among younger age groups:

- 15-24 year olds, down 10,840 jobs (3.1%)

- 25 – 34 years old, with 10,056 jobs down (1.8%)

- 35 and over, down 7,375 jobs (0.5%).

Vacancies for 15- to 24-year-olds have declined annually since August 2023, and 25- to 34-year-olds have started to show annual declines since May 2024.

“Business demand for labor has fallen over the past year and younger age groups may be most affected by changes in labor market supply and demand,” said Sue Chapman, employment data manager at at Stats NZ.

In July 2023, one third of all employed 15-34 year olds were in retail trade, accommodation and food services or the construction industry. While these industries fell by more than 18,000 jobs annually, the biggest declines among 15-34-year-olds in the year to July 2024 were:

- accommodation and food services, down by 6,841 jobs (6.7%)

- construction, with 6,460 jobs down (7.2%)

- administrative and support services, down 5,806 jobs (12.7%).

Westpac chief economist Michael Gordon said job losses were “now becoming evident across many industries”.

“Manufacturing, construction and retail trade have seen broad declines over the past year, but they are increasingly being joined by a number of service sectors. Health, public administration and finance are among the few remaining sources of growth,” he said.

“Even if we see some flattening of the jobs numbers in the coming months, the weak starting point for the September quarter means we are likely to see some weak results overall in the HLFS. We currently forecast an increase in the unemployment rate from 4.6% to 5.0% in the September quarter.”

The ASB’s Smith said he continued to expect the labor market to “progressively weaken” until 2025, with the balance of power gradually shifting in favor of employers.

“Weaker demand for labor is expected to be the main driver, with economic activity anemic in 2024. Pressures on profitability are also expected to significantly limit future employment and wage growth, with labor hoarding of work from 2022/23 increasingly likely to yield. to the loss of work.

“We expect the NZ unemployment rate to continue to rise, passing well above 5% by the end of 2024 and likely peaking at around 5½% in mid-2025. Leading indicators – jobs announcement and hiring intentions analyzed – indicates further. employment restriction”.

#fourth #consecutive #monthly #decline #number #jobs #filled #points #increases #unemployment